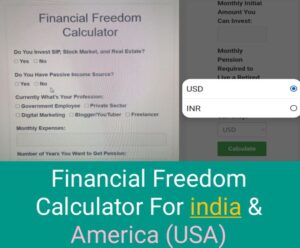

Financial Freedom Calculator for India and Usa – A Step-by-Step Guide

The financial freedom calculator on the internetgyankosh website allows you to calculate how much money you need to save to be financially free. To use the calculator, you need to enter the following information:

Introducing our Financial Freedom Calculator India that will help you plan your path to financial independence.

First of all, by clicking on this above Yellow Highlighted Button link, open the page in a new tab. After that, understand the answers to the questions.

1. Do You Invest SIP, Stock Market, and Real Estate?

2. Do You Have Passive Income Source? Work that [pays while sleeping]

3. Currently What’s Your Profession

What is your current occupation?

4. Monthly Expenses

5. Number of Years You Want to Get Pension (For how many years do you want to get pension after retirement?)

6. Expected Annual Return

What percentage of interest do you want every year.

7. Current Savings

Write the total savings amount. Means how much money do you have now.

8. Inflation Rate (%)

9. Monthly Initial Amount You Can Invest (Monthly initial amount that you can invest. How much money do you want to invest every month?)

10. Monthly Pension Required to Live a Retired Life Today ( It Means when you will leave your work. So how much money will be needed in a month to live life. Write that amount)

11. Currencies

(If you are Indian then select INR and if you are American then select USD)

12. Calculate

(After answering all the above questions, click on this green button. You will see the result. And one more useful thing, you can also take a printout of this result by clicking on the ‘Print’ button. Due to which you will get the benefit of the principle of Law of attraction.)

Another questions asked by F.F. Calculator available in the marketplace. So you can also learn meaning of below mentioned finance related questions.

- Your current monthly expenses

- Your desired annual expenses in retirement

- The current rate of return on your investments

- The number of years until you want to retire

- Inflation Rate (%)

The calculator will then calculate how much money you need to save to reach your financial freedom goal.

Here is an example of how to use the calculator

- Your current annual expenses are Rs. 10 lakhs.

- Your desired annual expenses in retirement are Rs. 5 lakhs.

- The current rate of return on your investments is 10%.

- You want to retire in 20 years.

- To calculate how much money you need to save to be financially free in India, you can use the financial freedom calculator and enter the current inflation rate of 5.3%.

The calculator will then calculate that you need to save Rs. 35 lakhs to reach your financial freedom goal. This is calculated by the following formula:

Financial freedom goal = (Desired annual expenses in retirement / (1 + Rate of return)^Number of years until retirement)

In this case, the calculation is as follows:

Financial freedom goal = (5 lakhs / (1 + 10%)^20) = 35 lakhs

Of course, the actual amount of money you need to save will vary depending on your individual circumstances. However, the financial freedom calculator can give you a good starting point for planning your retirement.

Here are some tips for using the financial freedom calculator

- Be as accurate as possible when entering your information. The more accurate your information, the more accurate the results of the calculator will be.

- Update your information as your circumstances change. If your annual expenses increase or decrease, or if the rate of return on your investments changes, be sure to update the calculator accordingly.

- Use the calculator as a planning tool. it can be a helpful tool for planning your retirement and making sure you are on track to reach your goals.

For USA audiences [american calculator for financial freedom]

Introducing our Financial Freedom Calculator USA that will help you plan your path to financial independence.

- The average annual expenses for a US household are $50,000.

- The average rate of return on investments is 7%.

- The average person retires at age 65.

- The amount of money you need to save to be financially free will vary depending on your individual circumstances.

- However, a good rule of thumb is to have 25 times your annual expenses saved by the time you retire.

- For example, if your annual expenses are $50,000, you would need to have $1.25 million saved by the time you retire.

- The financial freedom calculator can help you estimate how much money you need to save to reach your financial freedom goal.

- The inflation rate in the financial freedom calculator is set to 3%. This is the average inflation rate in the United States over the past 100 years.

30 Ways To Achieve Financial Freedom

- Set financial goals. What do you want to achieve financially? Do you want to retire early? Buy a house? Save for your children’s education? Once you know what you want, you can start to create a plan to reach your goals.

- Track your spending. Where is your money going? Once you know where your money is going, you can start to make changes to your spending habits.

- Create a budget. A budget is a plan for how you will spend your money. It can help you track your spending and make sure you are on track to reach your financial goals.

- Automate your savings. The best way to save money is to automate your savings. This means setting up automatic transfers from your checking account to your savings account. This way, you won’t even miss the money.

- Pay off your debt. Debt can be a major obstacle to financial freedom. The sooner you pay off your debt, the sooner you will be on your way to financial freedom.

- Invest your money. Investing your money is a great way to grow your wealth over time. There are many different investment options available, so you can choose ones that are right for you.

- Start a side hustle. A side hustle can be a great way to earn extra money and help you reach your financial goals faster.

- Live below your means. This means spending less money than you earn. This will free up more money to save and invest.

- Get a financial advisor. If you are struggling to reach your financial goals, a financial advisor can help you create a plan and stay on track.

- Learn about personal finance. The more you know about personal finance, the better equipped you will be to achieve financial freedom. There are many resources available to help you learn about personal finance, such as books, websites, and seminars.

- Eliminate unnecessary expenses. Take a close look at your spending and see if there are any areas where you can cut back.

- Negotiate your salary. Don’t be afraid to negotiate your salary when you are offered a new job.

- Get a raise. Once you are in your job, find ways to increase your earnings.

- Start a business. If you have a great idea, starting a business can be a great way to achieve financial freedom.

- Invest in yourself. Take courses, attend seminars, and read books to improve your skills and knowledge.

- Network with other people. Networking with other people can help you find new opportunities and learn from others.

- Be willing to take risks. Sometimes you have to take risks in order to achieve your financial goals.

- Be patient. It takes time to achieve financial freedom. Don’t get discouraged if you don’t reach your goals overnight.

- Be persistent. Don’t give up on your financial goals. There will be times when you feel like giving up, but it is important to keep going.

- Be positive. A positive attitude will help you stay motivated and on track to achieve your financial goals.

- Create a financial plan. A financial plan will help you track your progress and stay on track to reach your financial goals.

- Review your financial plan regularly. Your financial situation can change over time, so it is important to review your financial plan regularly.

- Get help from a financial advisor. If you are struggling to create or follow a financial plan, a financial advisor can help you.

- Be aware of your financial rights. There are many laws and regulations that protect your financial rights. Make sure you know what your rights are.

- Be prepared for emergencies. Set aside money in an emergency fund to cover unexpected expenses.

- Protect your assets. Get insurance to protect your assets in case of an unexpected event.

- Plan for retirement. Start saving for retirement as early as possible.

- Leave a legacy. Consider how you want to use your money to make a difference in the world.

- Enjoy the journey. Financial freedom is a journey, not a destination. Enjoy the process of building your wealth and achieving your financial goals.

- Help others. Once you have achieved financial freedom, consider helping others achieve their financial goals.

Use the financial freedom calculator on the internetgyankosh website to calculate how much money you need to save to be financially free. Take the first step towards achieving financial freedom today!

https://www.internetgyankosh.com

Entrepreneur | Content Creator | Traveller | Blogger | Digital Marketer | Social Activist.